Why Manual Tracking Still Works

Writing things down seems old school in a world of budgeting apps and auto syncing bank feeds. But here’s the thing it works. There’s something powerful about putting pen to paper when it comes to your money. It’s simple, yes but also honest. When you record every expense by hand, you’re forced to pay attention. That’s where the shift begins.

Manual tracking creates a layer of built in awareness. You can’t breeze past a $9 coffee or a late night impulse buy when you physically write it down. That process makes each decision a little more real. It slows you down just enough to start noticing your patterns. And once you’re aware, you’re in control.

This isn’t about being perfect it’s about being present. Daily tracking grounds your attention and gives you a clearer view of your habits. It becomes a form of accountability, not to a bank or an app, but to yourself. That small act of writing something down? It’s the first step toward spending with intention.

What You Actually Gain

Manual tracking forces you to face the truth about your money. When you write down every expense even the quick coffees or late night impulse buys you strip away the guesswork. Most people think they know where their money goes. They don’t. Manual logs make the invisible obvious.

Once the numbers are down, patterns start to emerge. Maybe that streaming bundle crept up to five subscriptions. Maybe food delivery is slowly becoming your second rent payment. You begin to spot your habits, your leaks, even the purchases you make when you’re tired, bored, or stressed.

And from that raw data your data you can actually set goals that fit your life, not someone else’s spreadsheet. Because knowing the problem is half the battle. The other half is making informed decisions. That starts the moment you start tracking, manually, with eyes wide open.

Tools That Keep It Simple

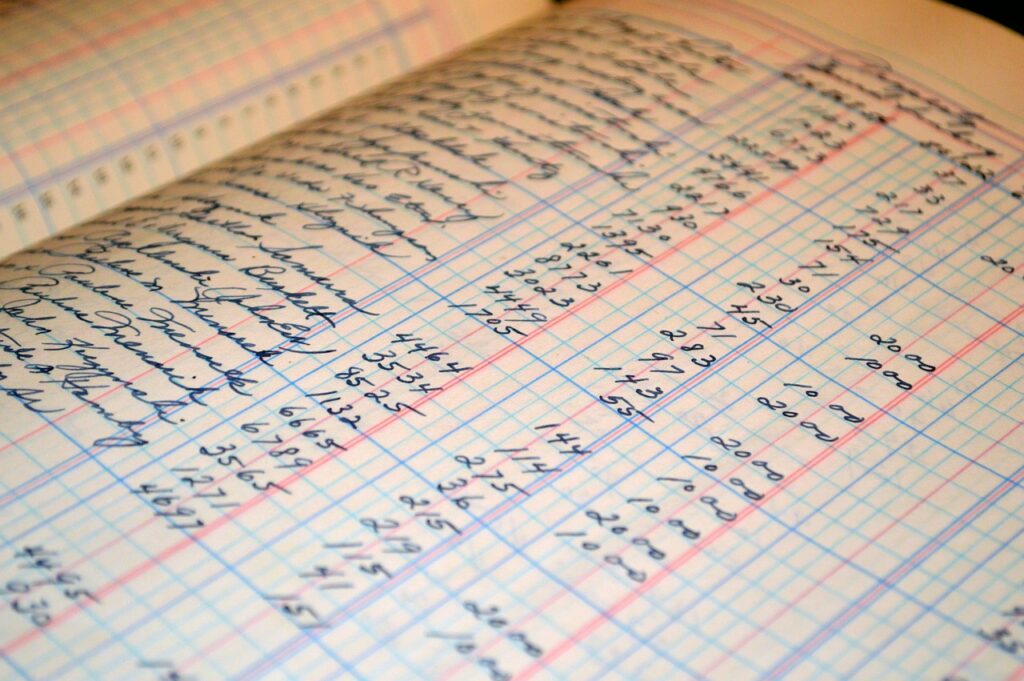

There’s no one right way to track your spending the best method is the one you’ll actually use. For some, the simplicity of a pen and notebook wins. You jot down what you spend, when, and on what. No tech, no distractions. For others, spreadsheets offer structure. They calculate totals, show trends, and help create real time visibility without extra apps. Printable trackers sit somewhere in the middle: pre made templates you can hang on your fridge, fold into your wallet, or keep by your desk.

The tool isn’t the magic. What matters is the habit. Daily or weekly check ins add up to real financial awareness. Write it down, review it, and reflect. Consistency beats complexity every time.

To get started, keep it low friction. Use whatever medium feels most natural then set a time every week to review. Habits stick when you make them obvious and convenient.

If you need guidance, check out these solid beginner resources: track finances manually.

Long Term Payoffs

Manual expense tracking isn’t just a short term budgeting trick it’s a habit that pays off in deeper ways over time. By consistently recording your spending, you gain more than numbers. You build a mindset that supports financial growth, communication, and confidence.

Budgeting Becomes a Discipline

Tracking expenses by hand makes your budget more than just a spreadsheet it becomes a daily practice. When you write each transaction down, you train your brain to be more thoughtful and proactive with money.

Reinforces daily awareness and delayed gratification

Strengthens habits through repetition

Builds a personal sense of control over finances

Confidence Grows with Clarity

When you know where every dollar is going, uncertainty fades. This clarity helps you stay calm in moments of doubt whether it’s reviewing your bank account, deciding on a big purchase, or adjusting your budget.

Reduces anxiety around spending decisions

Increases trust in your financial judgment

Motivates consistent progress toward goals

Money Conversations Get Easier

Money doesn’t have to be a stressful topic. When your finances are clearly tracked, it’s easier to talk with a partner, friend, or advisor about goals, concerns, or next steps.

Provides concrete details to guide discussions

Helps navigate shared expenses and long term planning

Breaks emotional tension by focusing on the facts

Manual tracking may seem small, but the long term benefits are meaningful. It’s a powerful foundation for better money habits that can last a lifetime.

What to Watch Out For

Tracking every dollar can feel like progress and it is, to a point. But here’s the trap: logging your expenses without changing your habits is like checking the weather and never bringing a coat. Awareness is good. Action is better. If you’re writing things down but still wondering where your paycheck disappeared to, it’s time to move from observation to adjustment.

Perfectionism is another killer. Spoiler: your budget is never going to be flawless. Missed entries, impulse buys, shifting goals it’s all part of the process. Don’t wait for a “perfect month” to start or restart. Consistency matters way more than precision. Done really is better than perfect.

Lastly, life doesn’t care about your spreadsheet. Priorities shift. Schedules derail. What worked six months ago might not work now. That’s not failure it’s a signal. Build a system that adjusts with you. Fewer categories when you’re busy. A reset after a move or job change. Flexibility keeps you in the game. Rigidity just burns you out.

Take the Next Step

Here’s your challenge: track every dollar you spend for one month. Not some of it. Not the easy stuff. All of it. Groceries, impulse buys, gas station snacks, subscriptions you forgot about everything.

You don’t need an app or a fancy system. Just use this straightforward manual method to get started: track finances manually. It walks you through a basic, high awareness approach that actually sticks.

After 30 days, review where your money went. You’ll see patterns. You’ll catch habits in the act. And from there, you’ll know what needs to shift and what doesn’t. This isn’t about judgment. It’s about building clarity and control. Give it a month. Learn more about yourself. Then decide what comes next.